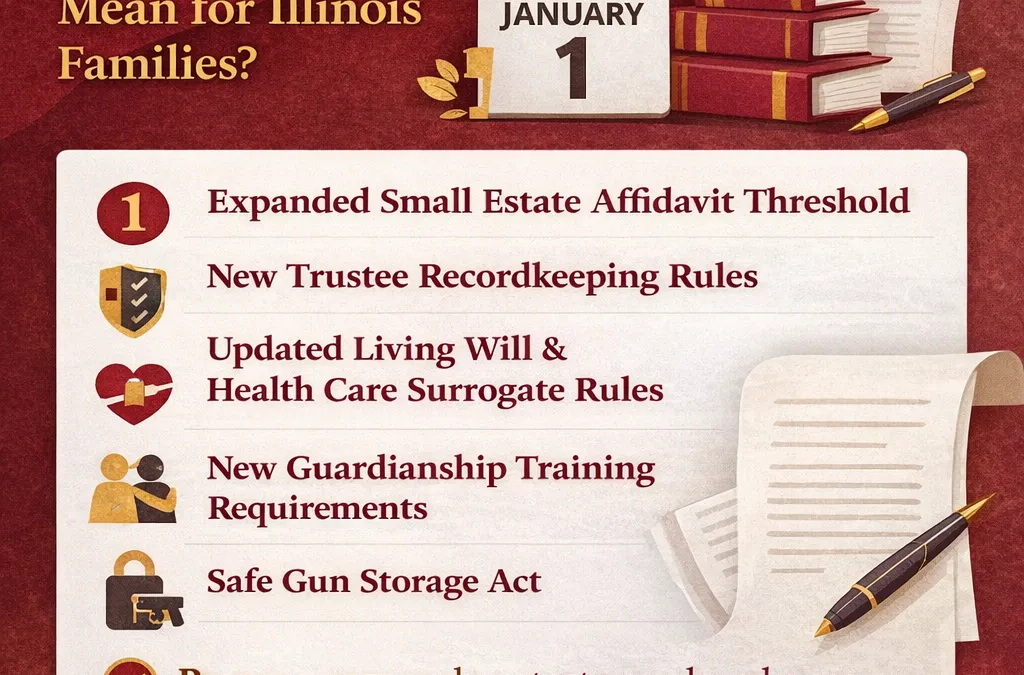

As we ring in 2026, several new Illinois laws go into effect that could impact your family’s planning, long-term care, probate matters, and property rights. Some of these changes make it simpler to settle a modest estate or strengthen protections for vulnerable adults, while others affect estate administration and guardianship responsibilities.

Here’s a straightforward breakdown of the top five Illinois law changes your family should know about effective January 1, 2026.

1. Expanded Small Estate Affidavit Threshold — Eases Probate for Modest Estates

Illinois has increased the dollar limit for using a Small Estate Affidavit to settle an estate without a full probate court proceeding. Under the new law, estates with only personal property (not including motor vehicles) valued up to $150,000 can qualify for this simplified process. This is up from the previous $100,000 threshold. JD Supra

Why it matters:

For many families, this means less cost and delay when settling the affairs of a loved one who passed away with a modest estate — especially if probate would otherwise take months and incur legal fees. JD Supra

2. New Trustee Recordkeeping and Compliance Duties

Trustees must now follow updated recordkeeping rules that affect how trusts are administered:

-

Trustees are required to keep key trust documents for seven years after the trust ends.

-

Trustees must also conduct a reasonable search for unclaimed or abandoned property before distributing trust assets, aligning trust administration with Illinois unclaimed property law. Katten

Why it matters:

If you’re named as a trustee — or you’re setting up a trust — these changes increase your responsibilities and documentation standards, helping avoid errors and legal challenges down the road. Katten

3. Updated Living Will and Health Care Surrogate Rules

Illinois revised the Living Will Act and the Health Care Surrogate Act to clarify how these documents interact with Physician Orders for Life-Sustaining Treatment (POLST) forms. The goal is to ensure that your treatment preferences are honored consistently across different types of advance health directives. Katten

Why it matters:

For families planning ahead, clarity and consistency between living wills, health care powers of attorney, and POLST forms reduce confusion during emotionally difficult decisions. Katten

4. New Guardianship Training Requirements

Under a change to the Guardianship and Advocacy Act and the Probate Act of 1975, guardians appointed for adults with disabilities must complete enhanced training that now includes:

-

Separate instruction on managing both personal care and financial or estate matters.

-

Approved training content determined by the Illinois State Guardian. LegiScan+1

Why it matters:

If you’re serving — or considering serving — as a guardian for a loved one, this new requirement ensures you’re better prepared to handle both health care and financial decisions with confidence. LegiScan

5. Safe Gun Storage Act and Related Protective Laws

Although not strictly an estate law, SB 0008 — the Safe Gun Storage Act — imposes new duties on gun owners to securely store firearms and report lost or stolen guns. Failing to do so can result in fines in certain circumstances. Illinois Legal Aid

Why it matters:

For families including seniors, vulnerable adults, or heirs who could be at risk, safe storage rules help protect your household and reduce the likelihood of tragic accidents. This is especially important when planning for a loved one’s long-term care and safety. Illinois Legal Aid

Additional Laws You Should Know About

While focused on estate and elder law relevance, Illinois is also rolling out other important changes on January 1, 2026:

-

A statewide ban on discriminatory artificial intelligence in hiring decisions. Jacksonville Journal-Courier

-

Enhanced powers for police to remove squatters from private property without formal eviction. Jacksonville Journal-Courier

-

Expanded Move Over Law protections for emergency responders. Jacksonville Journal-Courier

These laws affect Illinoisans broadly and can intersect with your family’s long-term planning or property rights. Jacksonville Journal-Courier

What You Can Do Next

📌 Review your estate plan to ensure trusts, wills, powers of attorney, and health care directives reflect the latest standards and requirements.

📌 Check trustee responsibilities — if you are serving as a trustee, update your recordkeeping practices now.

📌 Talk to your attorney about how these changes may impact your family’s specific situation.

If you have questions about how these new Illinois laws affect your estate planning, guardianship, or probate matters — contact the Law Office of Jonathan W. Cole P.C.

📞 (708) 529-7794 | Law Office of Jonathan W. Cole P.C. — “Your Neighborhood Law Firm.”