Have you ever wondered whether your estate plan would actually work when your family needs it most? Many Illinois families have documents in place — but small, common mistakes can still lead to court delays, family conflict, and unnecessary costs.

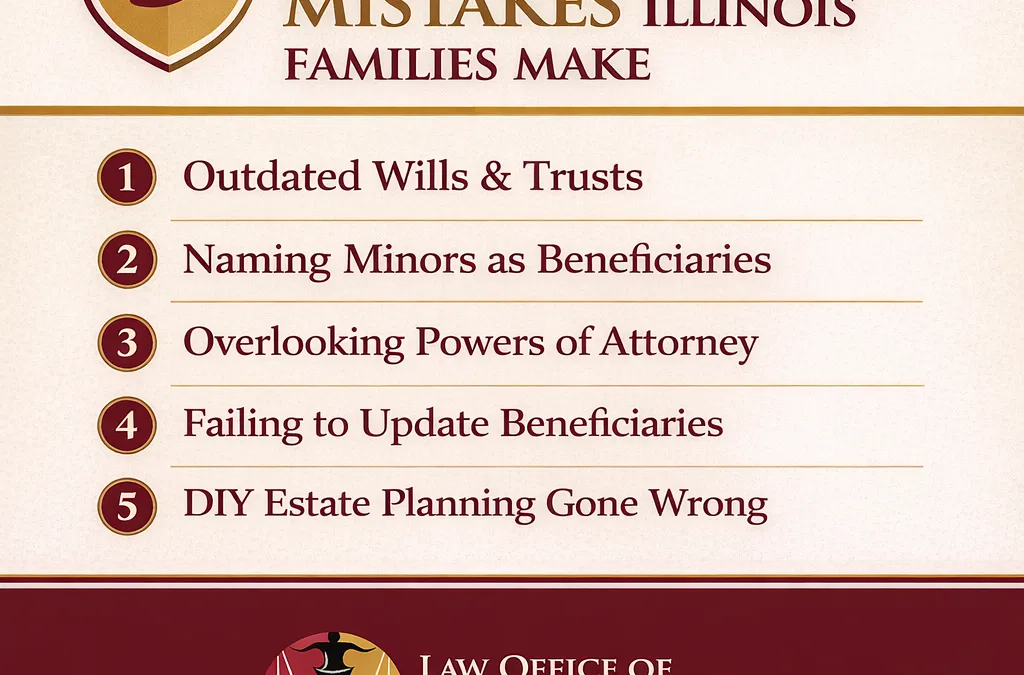

Below are five estate planning mistakes we see regularly, and what you can do to avoid them.

- Not Having a Will or Trust at All

This is the most common mistake — and often the most costly.

If you pass away without a will in Illinois, state law decides who inherits your property. That may not reflect your wishes, especially if you have a blended family, minor children, or specific people you want to protect.

How to avoid it:

Create at least a basic estate plan that clearly states who should receive your assets and who should handle your affairs.

- Assuming Everything Will “Just Go” to Your Spouse

Many married couples believe everything automatically transfers to the surviving spouse. In Illinois, that’s not always true — especially if there are children from a prior relationship.

Without proper planning, assets can end up divided in ways you never intended.

How to avoid it:

Review how Illinois inheritance laws apply to your family structure and use a will or trust to clearly direct distributions.

- Naming Minor Children Directly as Beneficiaries

Leaving assets directly to a minor can create serious problems. Courts may have to step in to appoint a guardian, and your child won’t receive full control until age 18 — regardless of maturity or readiness.

How to avoid it:

Use a trust to manage assets for minor children and name a trusted adult to handle funds responsibly.

- Failing to Update Beneficiaries and Documents

Life changes — marriages, divorces, births, deaths — but many estate plans don’t keep up.

Outdated beneficiary designations on life insurance, retirement accounts, or bank accounts can override your will entirely.

How to avoid it:

Review your estate plan every few years and after major life events to ensure everything still reflects your wishes.

- Missing Powers of Attorney for Healthcare and Finances

Estate planning isn’t just about what happens after death. Without powers of attorney, your loved ones may need court approval to help you if you become incapacitated.

How to avoid it:

Put Illinois-compliant healthcare and financial powers of attorney in place so someone you trust can act on your behalf when needed.

Protect Your Family with the Right Plan

Estate planning doesn’t have to be complicated — but it does need to be done correctly. A thoughtful plan can spare your family stress, delay, and unnecessary expense.

If you have questions about your estate plan or a probate matter, contact the Law Office of Jonathan W. Cole P.C. at (708) 529-7794 — Your Neighborhood Law Firm.